When it comes to VA and FHA home purchases many people often ask if we can do an FHA or VA inspection. In the State of Nevada all home inspectors are required to be licensed. The licensing law was constructed to conform to all state and federal standards. So the answer to the question is; yes.

When it comes to VA and FHA home purchases many people often ask if we can do an FHA or VA inspection. In the State of Nevada all home inspectors are required to be licensed. The licensing law was constructed to conform to all state and federal standards. So the answer to the question is; yes.

But this brings to light a common misconception. What many people fail to understand is that the VA or FHA loan is not being provided by the VA or FHA (except in rare circumstances). The VA or FHA are only guaranteeing the loan. The loan is being provided by a commercial non-governmental lender.

Because the VA or FHA guarantee is a component of the loan it is the lender is tasked with ensuring the loan meets the requirements of the VA or FHA in order to receive the associated loan guaranties. In those requirements are verification that the property meets certain health, safety, and habitability standards.

The home inspector is not employed by the lender. The home inspector is employed by the Buyer. 99.999% of the time the home inspector has no knowledge of who the lender is. The inspector does not provide a copy of the inspection report to the lender (unless specifically requested and only with permission). So it is not the home inspector’s job to verify whether the home meets or exceeds VA or FHA standards; it is the lenders responsibility.

How then does the lender verify the property meets the required VA or FHA health, safety, and habitability standards? It’s accomplished through the appraiser.

Appraisers are well versed in VA and FHA health, safety, and habitability standards. They will review the home to ensure it conforms. When they find issues that do not conform to VA or FHA health, safety, and habitability standards they call them out as appraisal conditions. Appraisal conditions become underwriter conditions. Underwriter conditions are conditions that must be satisfied (corrected) in order for the loan to fund.

Here are the most common issues found in Las Vegas homes that result in appraisal conditions:

Plumbing

- Seismic Restraint Straps (AKA Earthquake straps) missing on the water heater.

- Defective plumbing installed (i.e. KITEC)

- Plumbing leaks; faucets, toilets, etc…

Roofing

- The appraiser is required to inspect the attic for evidence of possible roof problems.

- The roofing must be sound. It must keep out moisture.

- The roofing must be expected to last for at least two more years. If questionable the appraiser may require a roof certification.

- Shingle roofing cannot have more than three layers of roofing.

- If the appraiser determines there is the need for roof repairs and the roof already has three or more layers of shingles, the FHA requires a new roof.

Heating and air conditioning

- All habitable rooms must have a functioning heat source.

- The home must have functioning air conditioning. (This FHA requirement is regional and applies to all homes in our region of the country)

Doors and Windows

- All doors leading to the exterior must be relatively free of damage and functional.

- The door between the interior of the home and the garage is required to be fire-rated, self-closing, and self-latching.

- Crack window glazing (glass) is required to be replaced.

Interior issues

- Handrails are required to be installed where appropriate.

- Defective floor finish or covering (worn through the finish, badly soiled carpeting)

- Damaged or worn out counter tops.

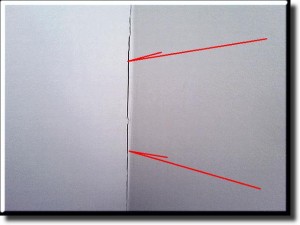

- Damaged plaster, sheetrock or other wall and ceiling materials in homes constructed pre-1978 (lead based paint concern).

- Trip hazards (including damaged and poorly installed carpeting)

- All smoke alarms are required to be present and functional.

- Exposed electrical wiring or evidence of improper electrical modifications.

There are other issues that the appraiser may call out.

Structural Soundness

Any defective structural conditions and any other conditions that could lead to future structural damage must be remedied before the property can be sold. These include defective construction, excessive dampness, leakage, decay, termite damage and continuing settlement. All VA loans require a termite inspection to be performed.

Appliances

FHA requires properties to have working kitchen appliances, particularly a working stove.

Bathrooms

The home must have an operable toilet, sink and shower. (An REO home that has been cannibalized and stripped of plumbing features cannot receive FHA or VA guaranteed funding)

Property Access

The property must provide safe and adequate access for pedestrians and vehicles. The street must have an all-weather surface so that emergency vehicles can access the property under any weather conditions.

Asbestos

If the appraiser suspects the home contains asbestos that appears to be damaged or deteriorating, the FHA requires further inspection by an asbestos professional.

Swimming Pools

Swimming pools must be operational to provide Contributory Value in the appraisal. The appraiser is required to report readily observable defects in a non-covered pool that would render the pool inoperable or unusable. If the pool water contains algae or demonstrates evidence of severely neglected chemistry the appraiser may require that the water be brought back to a normal operating condition. Pools with unstable sides or structural issues may be required to be repaired or permanently filled in accordance with local guidelines.

Non-permitted additions and / or conversions

Often additions and remodels are not accomplished utilizing the benefits of the permit process. Appraisers are not code compliance inspectors but they are familiar with what is typical and consistent with acceptable building standards and practices. If the appraiser suspects an addition or modification is not in conformance with applicable building code the FHA may require that these items be brought to code. If FHA decides to approve the loan without that requirement, FHA will not consider the value of non-permitted items in its appraisal.